Have a Question?

Find Answers Here

What is SPV?

What is LTV and why do some projects don’t have LTV?

What is a claim unit?

What is “book value” and why is it different from the “invested”?

Book value is the amount that reflects the price of the property or principal debt according to the valuation of this project.

For example, you made an investment into 10 000 claim units of the Rental project at 1.00 EUR per share. After some period the price of this property has increased 7% with the new appraisal and now your 10 000 claim units are worth 10 700 EUR. You still have 10 000 claim units, but the book value of this investment is now 10 700 EUR.

It can also be the other way around, if you buy 10 000 claim units of any project on Secondary Market with average price of 1.03 per unit, your investment will still have a book value of 10 000 EUR (if the price of claim unit of this project didn’t increase), but you have invested 10 300 EUR. In this case at the end of such a project you will be paid back 10 000 EUR (nominal value of claim unit) and 300 EUR will be your Capital Loss.

Please note that the book value of “loan” is not changing over time and stays at 1.00 EUR per unit.

What is Gross and Net Yield?

Gross Yield is an estimated annualised return the project is providing on an annual basis without deduction of the related expenses for operating this project. It does not include the Capital Gain that you receive from the increase of the value of the property. It’s calculated based on concluded or upcoming rental contracts.

Net Yield is an estimated net return the project is providing on an annual basis after deducting operation related expenses. In other words: Income that property generates minus all related expenses and amortisation.

What is XIRR and how is it calculated?

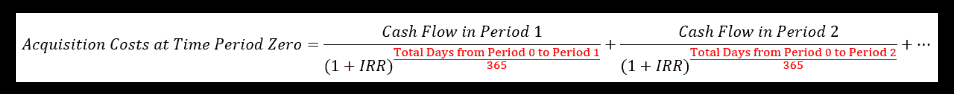

XIRR (Extended Internal Rate of Return) is an IRR (Internal Rate of Return) adjusted for time of payouts. It reflects the performance of your investments adjusted for the dates, when the payout of interests or principals happen.

The manual calculation of XIRR is pretty complicated:

The easiest way to calculate XIRR is to use Excel built-in function XIRR().

What are “bullet” and “full bullet” loan types?

Bullet loan - a loan type, when the repayments of interests accrued from the outstanding loan amount are repaid regularly - monthly/quarterly/half-annually/annually.

Full bullet loan - a loan type, when the repayment of interests accrued from the outstanding loan amount is done together with principal, at loan's maturity date.

Read more about each type of payments in this article - 3 types of repayment schedules and which is best for you